The cryptocurrency market has reached a historic milestone, with Bitcoin surpassing the $100,000 mark in December 2024. This remarkable achievement underscores the growing influence of digital currencies in the global financial ecosystem. While Bitcoin’s rise has excited investors worldwide, it has also highlighted how China, once a dominant force in the crypto sector, has fallen behind the US, driven by policy shifts, regulatory actions, and geopolitical dynamics.

Bitcoin’s Journey to $100K

Bitcoin’s ascent to $100K has been fueled by several key factors:

- Institutional Adoption: Major institutions, including BlackRock and Fidelity, launched Bitcoin exchange-traded funds (ETFs), driving demand.

- Global Regulatory Clarity: Clearer regulatory frameworks in the US and Europe boosted market confidence.

- Scarcity and Halving Anticipation: With Bitcoin’s supply capped at 21 million and the next halving expected in 2024, investors rushed in, anticipating further price increases.

- Geopolitical Tensions: Economic uncertainty and geopolitical conflicts pushed investors toward Bitcoin as a safe-haven asset.

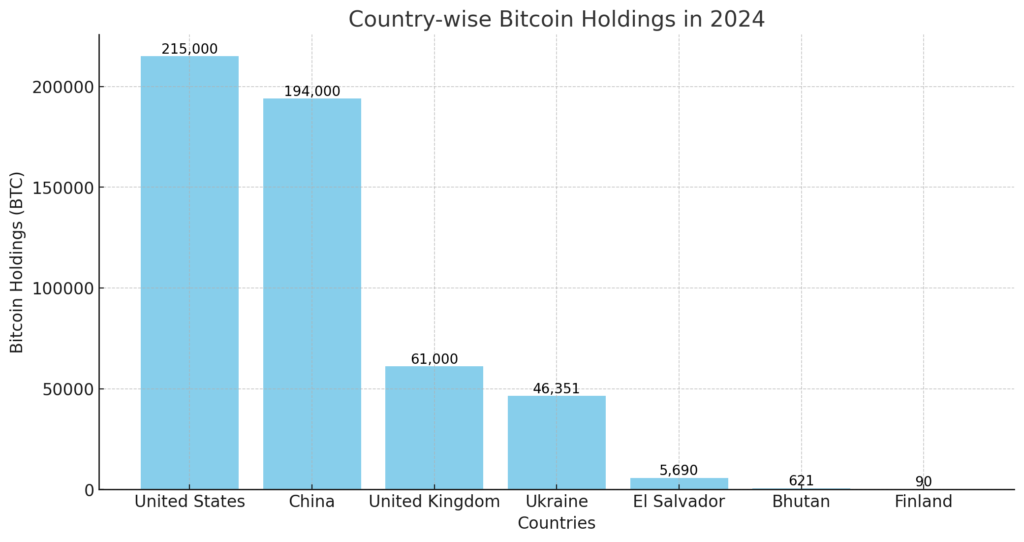

Top countries holding Bitcoin in 2024

Here is a summary of the top countries holding Bitcoin in 2024 based on the latest data:

- United States: The US leads with approximately 215,000 BTC, mainly acquired through law enforcement seizures like the Silk Road takedown.

- China: Holds around 194,000 BTC, largely obtained from the PlusToken Ponzi scheme seizure, valued at $19.3 billion.

- United Kingdom: Possesses about 61,000 BTC, worth $6 billion, confiscated from criminal activities.

- Ukraine: Holds 46,351 BTC, used partly for economic stability amid ongoing conflict.

- El Salvador: Owns 5,690 BTC, acquired through national purchases and investment programs, currently worth over $397 million.

- Bhutan: Maintains a treasury of 621 BTC, signaling its interest in digital assets for diversification.

- Finland: Has 90 BTC remaining after selling 1,889 BTC seized in criminal cases.

I will create a chart visualizing these country-wise Bitcoin holdings.

Here is a bar chart displaying country-wise Bitcoin holdings in 2024. The United States and China lead with significant reserves, followed by the United Kingdom and Ukraine. Let me know if you’d like additional customization or more detailed data visualizations!

How China Lost the Crypto Race

1. Regulatory Crackdowns

China was once the epicenter of cryptocurrency activity, controlling nearly 75% of the world’s Bitcoin mining in the early 2020s. However, Beijing’s crackdown on crypto mining and trading in 2021 disrupted its dominance. Major mining operations relocated to North America, Central Asia, and Eastern Europe.

2. Tech Exodus

China’s restrictive policies led to a mass exodus of tech talent and blockchain companies to crypto-friendly regions, particularly the US and Singapore. This migration accelerated the decline of China’s crypto innovation sector.

3. US Seizures and Market Control

The US capitalized on China’s retreat by enforcing strategic crypto asset seizures from criminal operations like the Silk Road and the PlusToken Ponzi scheme. These actions allowed the US government to build a significant Bitcoin reserve, strengthening its position in the global crypto market.

Trump’s Role in the Crypto Surge

Donald Trump’s unexpected entry into the crypto conversation in late 2024 further shifted the balance. Once a critic of Bitcoin, Trump reversed his stance during his campaign for re-election, embracing the asset as a hedge against what he described as “government mismanagement.”

Policy Shift

Trump proposed pro-crypto policies, including tax incentives for Bitcoin miners, promoting the US as a Bitcoin mining hub. His administration’s policy reversal led to an influx of foreign investment in US crypto infrastructure.

Global Impact

Trump’s endorsement gave Bitcoin a credibility boost among conservative investors. His support also influenced emerging markets looking for an alternative to dollar dependency, further driving global demand.

How Bitcoin ETFs Changed the Game for the US

The introduction of Bitcoin exchange-traded funds (ETFs) has solidified the US’s position as a global crypto leader. A Bitcoin ETF tracks Bitcoin’s price, allowing investors to gain exposure without directly purchasing the cryptocurrency. This innovation has bridged the gap between traditional finance and digital assets.

Key Impacts

- Institutional Adoption: Major asset managers like BlackRock and Fidelity attracted institutional capital, driving Bitcoin’s price beyond $100K in 2024.

- Regulatory Legitimacy: The US Securities and Exchange Commission (SEC) approved Bitcoin ETFs, providing a legal framework that boosted investor confidence.

- Market Liquidity & Price Discovery: ETFs improved Bitcoin’s trading volume, stabilizing prices and enabling accurate market valuation.

- Financial Innovation: New products like futures ETFs and crypto-bond hybrids emerged, diversifying investment portfolios.

- Global Influence: US exchanges like Nasdaq became international trading hubs, strengthening the dollar’s dominance.

- Wealth Creation: ETFs generated billions in investments, fees, and tax revenue, boosting US economic growth.

By legitimizing Bitcoin in traditional finance, Bitcoin ETFs helped the US dominate the global crypto economy, setting a benchmark for regulatory and financial innovation.

The Future of Crypto Dominance

With Bitcoin at $100K, the question now is which country will dominate the next phase of the crypto economy. While the US has surged ahead, other nations may still reclaim influence by fostering crypto-friendly environments. China’s blockchain ambitions persist, but its restrictive stance on decentralized currencies may hinder its comeback.

The crypto race is far from over, but for now, the US stands at the top, and Bitcoin’s $100K milestone is a testament to its resilience in the face of shifting geopolitical tides.